US politics

fromwww.mercurynews.com

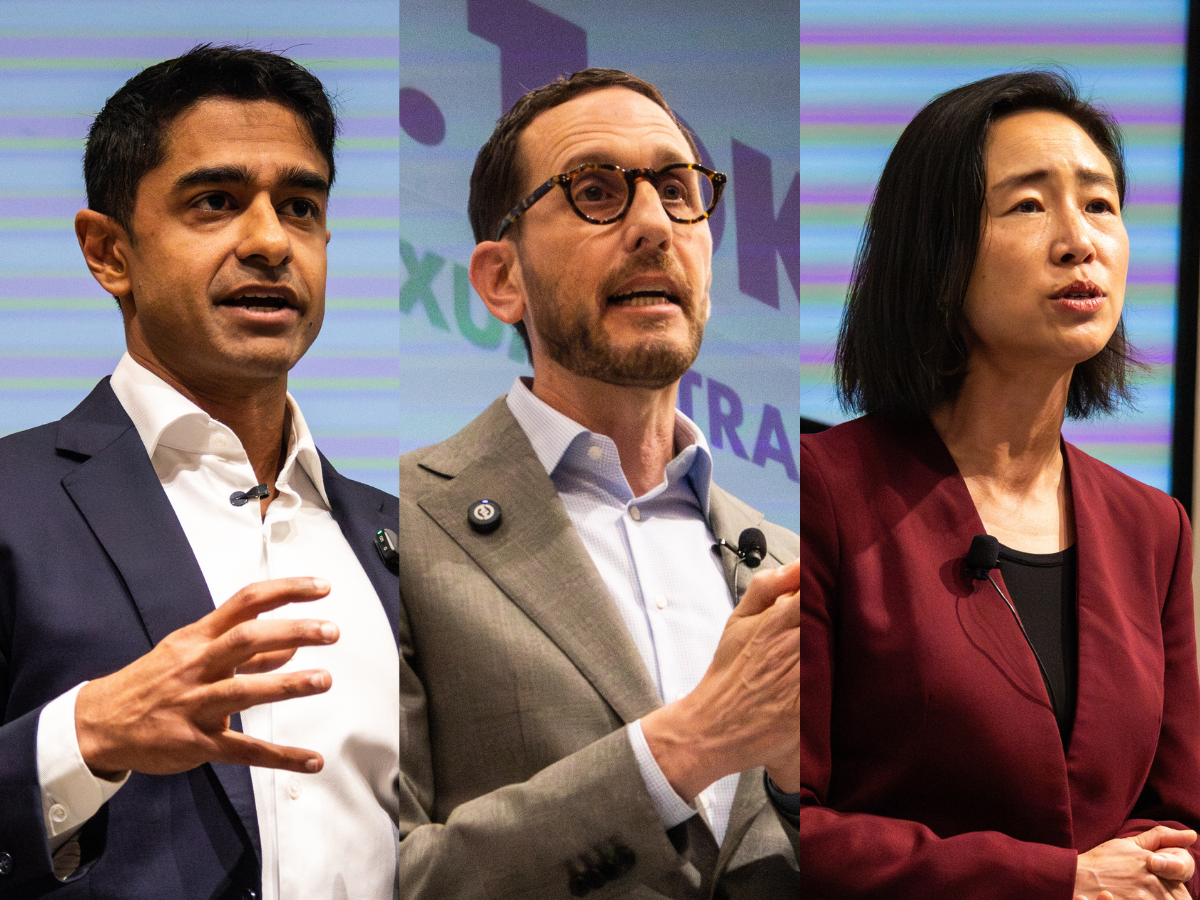

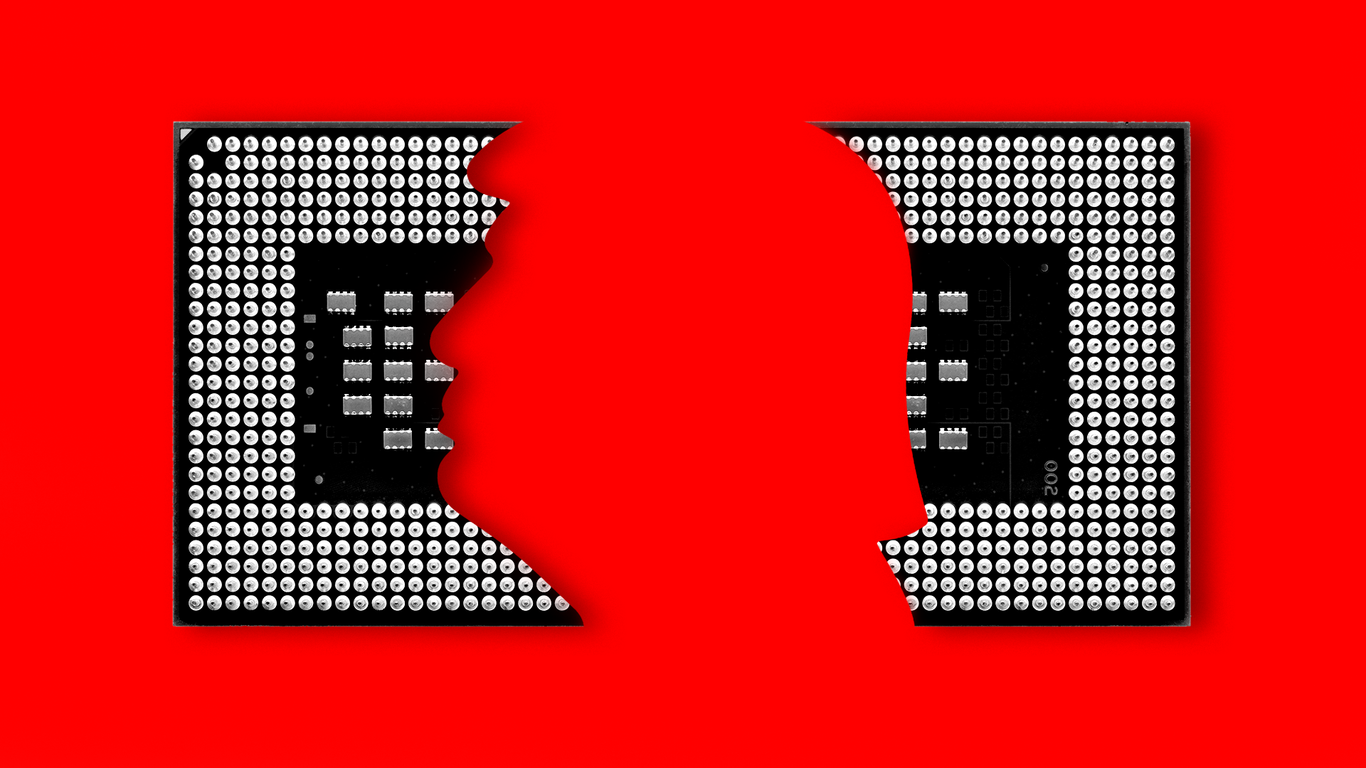

2 days agoUS senators press Intel over ties to firm with sanctioned units

Six bipartisan senators demand Intel explain its relationship with blacklisted semiconductor equipment maker ACM Research due to national security concerns involving Chinese military-connected companies.